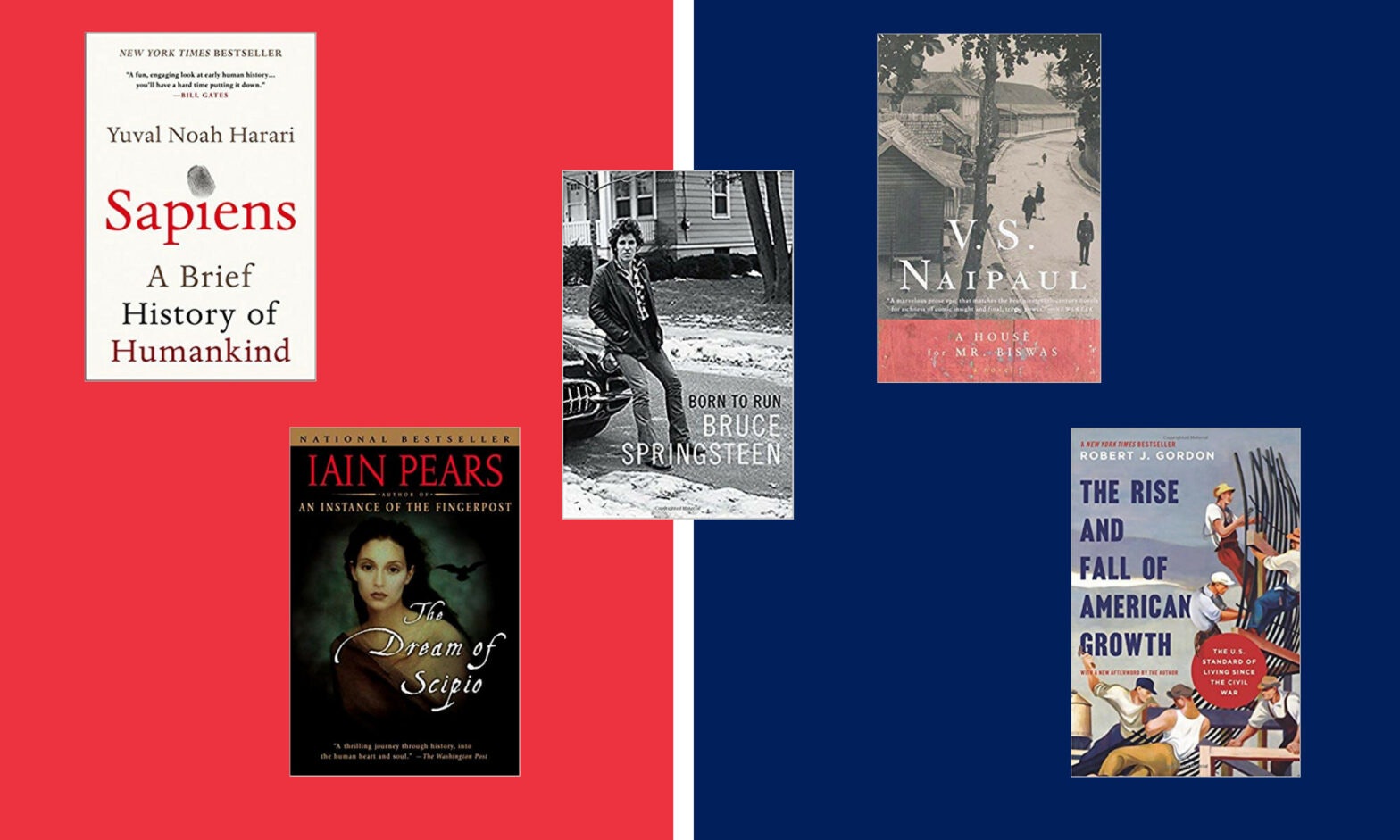

As these five books illustrate, insights into economic growth sometimes show up in surprising places.

Bruce Springsteen’s iconic song “Born to Run” topped the music charts and his book of the same title made the bestseller list, but most people don’t think of him as contributing to discussions of economic policy. Consider, though, that the story of economic growth is not just about numbers. It’s actually a story of people, creativity, near-misses, and improbable breakthroughs. And it teaches us that we can’t take growth for granted.

Springsteen’s memoir Born to Run provides music fans with a highly readable account of the enormous commitment and sustained hard work at the heart of human creativity. “The Boss” arrives at his band’s one-of-a-kind sound only after a decade of non-stop experimentation and live performing, only after building a unique and remarkably diverse organization, and only after tapping into a vast array of influences in the hot-house creative environment of New York. The takeaway for economic policy: growth is a function of creativity, and the best way to promote growth is to foster an environment in which creativity flourishes.

To economists, long-term economic growth is a straightforward process. It’s the steady rise in economic output and living standards that arises from technological progress, increasing human capital in the form of education and practical know-how, and a growing stock of physical capital.

Over the last generation, economists have added immeasurably to our understanding of the conditions that give rise to healthy long-term growth. The most popular explanations for successful growth have focused on the role of good public-sector institutions and growth-friendly cultural environments. A particularly important strand in literature shows how devastating bad policies can be for growth – especially policies that promote “crony capitalism,” weaken property rights, or diminish the incentives for people to invest in their own human capital.

But history also has a great deal to teach us about economic growth. An indispensable history of growth in our country is The Rise and Fall of American Growth by economist Robert J. Gordon. Gordon’s magisterial history makes two compelling points.

First, the high growth rates in labor productivity and economic output that America achieved between 1920 and 1970 were a historical outlier. They resulted from the emergence of a handful of transformative “general purpose technologies” (GPTs) during the previous 50 years, notably electricity and the internal combustion engine. Growth continued at unprecedented rates through 1970 because it took fully a century for these technologies to roll out through the economy and transform the lives of ordinary Americans.

Second, Gordon shows that productivity has slowed more or less continuously since 1970 because the new GPTs of our era – wondrous though they are – simply haven’t proved to be as transformative as the technologies of a century ago. Whether the impact of modern information technology will cause growth to accelerate from here is an open question.

Yuval Noah Harari looks at human progress through a still wider lens in his brilliant bestseller Sapiens: A Brief History of Humankind. His tightly constructed account of the rise of modern civilization over the past 70,000 years highlights the central role of widely shared beliefs in making complex economic and political arrangements possible. For instance, economic growth has increasingly relied on shared beliefs in abstract concepts such as “money,” “the rule of law” “private property,” and “nation-states.” We believe others will respect our “property” and accept our “money” in exchange for goods; otherwise we wouldn’t invest so much effort in accumulating them. But systems of shared beliefs are fragile. Old beliefs have crumbled repeatedly in history, and our own civilization needs to invest more effort in shoring up the foundational beliefs that keep modern growth on track.

Further afield, we can learn much from great novels.

V.S. Naipaul’s early novel A House for Mr. Biswas illustrates how one family’s beliefs regarding the possibilities arising from education undergo a revolution in a handful of decades. The Nobel Prize-winning economist Robert Lucas called this book one of the greatest ever novels on economic development, as it explores the habits of mind that drive growth and prosperity rather than acceptance of pre-modern poverty.

The British novelist Iain Pears shows in The Dream of Scipio how human progress can go into reverse in his imaginative, intertwined story of three families living in the same spot in Southern France as three dark ages descend: the fall of the Roman Empire, the Black Death, and the Nazi conquest of France. This haunting novel reminds us that history does not move in a straight line, and growth is no sure thing.

The quest to create, innovate, and grow is a central element of the human drama. As these books memorably illustrate, insights into growth sometimes show up in surprising places.